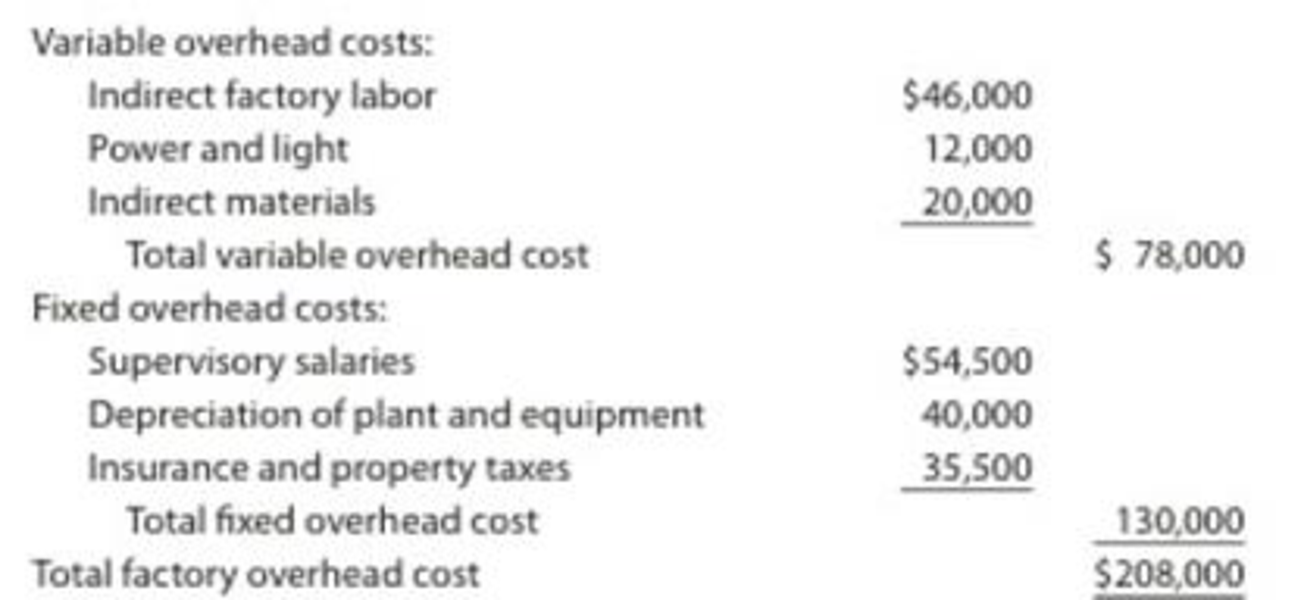

Variable Overhead Cost Variance | Our variable overhead cost variances homework help service will not be helpful in the true sense, until and unless students understand what is. Variable overhead expenditure variance =. Manufacturing overhead costs refer to any costs within a manufacturing facility other than direct material and direct labor. Total fixed cost 4.00 3.00 0.50 7.50 flexible budget actual results 8,000 8,000 variances 0 $ 34,000 25,500 3,800 $ 63. The variable overhead spending variance is a compilation of production expense information submitted by the production department and the projected labor hours to be worked, as estimated by the industrial engineering and production scheduling staffs, based on historical and projected.

Total fixed cost 4.00 3.00 0.50 7.50 flexible budget actual results 8,000 8,000 variances 0 $ 34,000 25,500 3,800 $ 63. Overhead cost variance can be defined as the difference between the standard cost of overhead allowed for the actual output achieved and the actual variable overhead efficiency variance can be calculated if information relating to actual time taken and time allowed is given. The cost allocation base used by an operating manager is classified as multiple choice questions (mcq) on planning of variable and fixed overhead costs with choices machine hours. 40,000 for variable overhead cost and 80,000 for fixed overhead cost were budgeted to be incurred during that period. The variable overhead spending variance is a compilation of production expense information submitted by the production department and the projected labor hours to be worked, as estimated by the industrial engineering and production scheduling staffs, based on historical and projected.

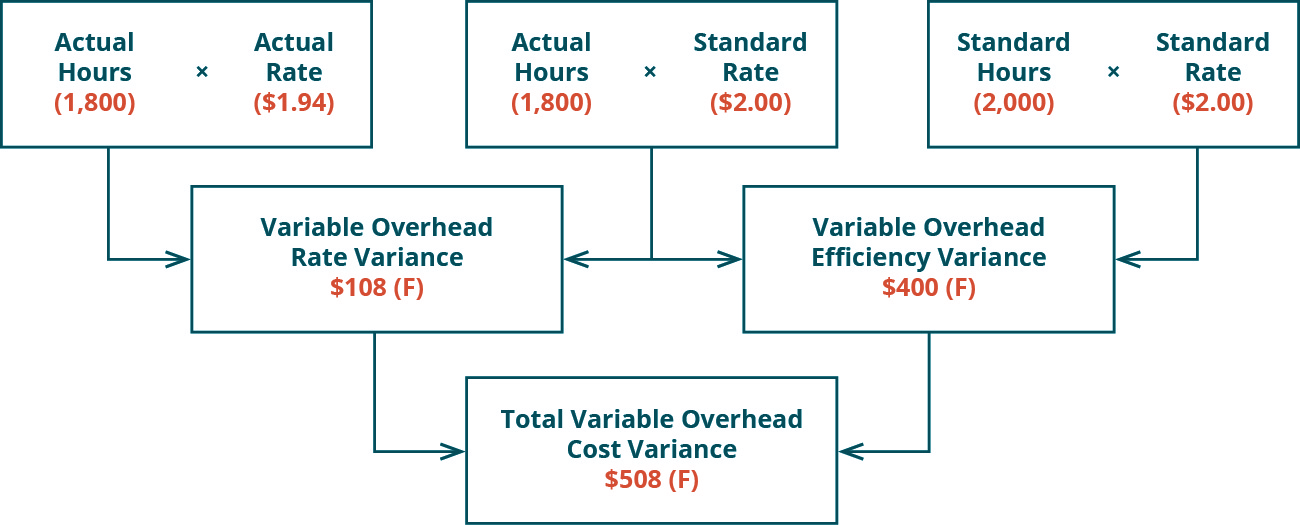

Manufacturing overhead costs refer to any costs within a manufacturing facility other than direct material and direct labor. Manufacturing overhead includes such things as indirect labor, indirect materials. A variable overhead efficiency variance formula calculates the difference between the standard number of manufacturing hours expected to produce a unit and the actual number of hours. Variable overhead spending variance is a measure of the difference between the actual variable overhead and the standard variable overhead rate multiplied by the actual activity. Variable overhead cost variance = expenditure variance + efficiency variance. The total overhead variance is the difference between actual overhead costs and overhead costs applied to work done. The variable overhead spending variance is the difference between actual costs for variable overhead and budgeted costs based on the standards. Variable overhead spending variance is the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. The cost allocation base used by an operating manager is classified as multiple choice questions (mcq) on planning of variable and fixed overhead costs with choices machine hours. Variable overhead spending variance variable overhead efficiency variance variable overhead. Home » standard costing and variance analysis » variable overhead efficiency variance. The standard variable overhead rate is typically expressed in terms of machine hours or labor hours. For a particular production department, the standard variable overhead has been budgeted as below:

A variable overhead efficiency variance formula calculates the difference between the standard number of manufacturing hours expected to produce a unit and the actual number of hours. Variable overhead spending variance is a measure of the difference between the actual variable overhead and the standard variable overhead rate multiplied by the actual activity. Variable overhead cost variance = expenditure variance + efficiency variance. Often, explanation of this variance will need clarification from the. Interpretation of the variable overhead rate variance is often difficult because the cost of one overhead item, such as indirect labor, could go up, but another overhead cost, such as indirect materials, could go down.

Variable overhead efficiency variance is traditionally calculated on the assumption that the overheads could be expected to vary in proportion to using activity based costing in the calculation of variable overhead variances might therefore provide more relevant information for management. For a particular production department, the standard variable overhead has been budgeted as below: Variable overhead spending variance (also known as variable overhead rate variance and variable overhead expenditure variance) is the difference between actual variable manufacturing overhead incurred and actual hours worked during the period multiplied by standard variable overhead rate. Often, explanation of this variance will need clarification from the. Variable overhead spending variance is the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. Calculation of variable overhead variances and an example. Variable overhead spending variance variable overhead efficiency variance variable overhead. Variable overhead expenditure variance =. Variable overhead efficiency variance is the difference between budget allowance based on actual hours worked and budget allowance based on standard hours allowed. Note, however, that fixed factory. Calculating variable overhead cost variance based on output and time. Compute the overhead variances for the month: Manufacturing overhead includes such things as indirect labor, indirect materials.

Let's take the example of the hasty hare corporation. Variable overhead efficiency variance is the difference between budget allowance based on actual hours worked and budget allowance based on standard hours allowed. Budgeted variable overhead for the period. So answering your question, what is the cost driver, hours or, variable overhead applied to production. The difference between actual variable overhead rates and predetermined variable overhead rates is known as overhead variance.

In addition, different managers are usually responsible for buying and using inputs. Variable overhead expenditure variance =. So answering your question, what is the cost driver, hours or, variable overhead applied to production. Variable overhead spending variance is the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. Total fixed cost 4.00 3.00 0.50 7.50 flexible budget actual results 8,000 8,000 variances 0 $ 34,000 25,500 3,800 $ 63. Now consider the variable overhead efficiency variance. Variable overhead cost variance = expenditure variance + efficiency variance. Calculating variable overhead cost variance based on output and time. What planning can be done? Variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance and fixed overhead volume variance explain why the variances are favorable or unfavorable requirement 1. Flexible budget variance (also variable overhead variance) = spending variance + efficiency variance. Interpretation of the variable overhead rate variance is often difficult because the cost of one overhead item, such as indirect labor, could go up, but another overhead cost, such as indirect materials, could go down. 40,000 for variable overhead cost and 80,000 for fixed overhead cost were budgeted to be incurred during that period.

Variable Overhead Cost Variance: Manufacturing overhead costs refer to any costs within a manufacturing facility other than direct material and direct labor.

Source: Variable Overhead Cost Variance